20 Aug Step-by-Step Guide to Invoice Process Automation

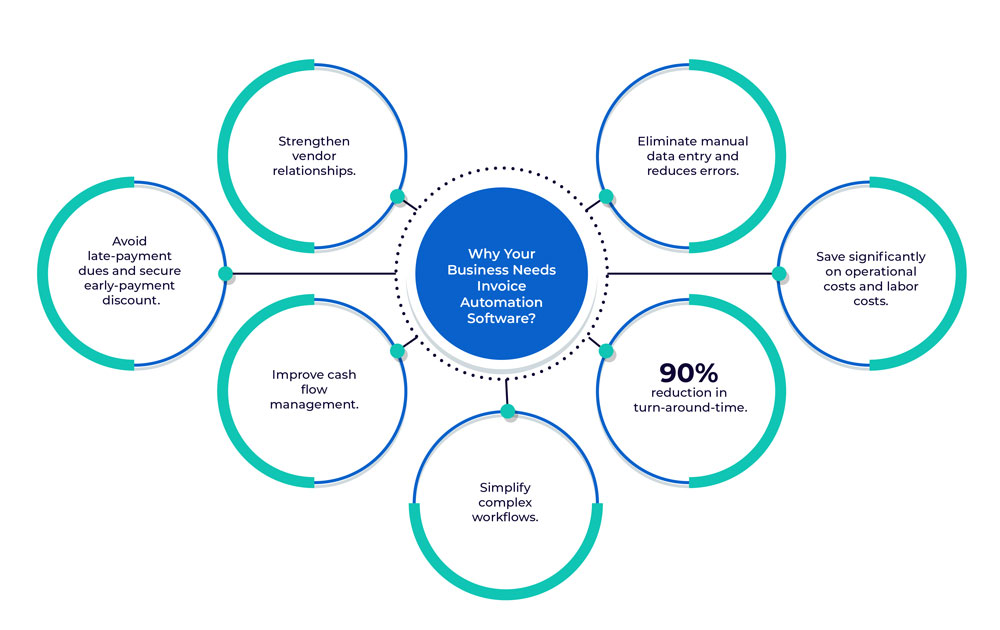

Why Your Business Needs Invoice Automation Software?

- Eliminate manual data entry and reduces errors.

- Save significantly on operational costs and labor costs.

- 90% reduction in turn-around-time

- Simplify complex workflows.

- Improve cash flow management.

- Avoid late-payment dues and secure early-payment discount

- Strengthen vendor relationships.

What is invoice process automation?

Invoice processing automation, also known as accounts payable (AP) automation uses advanced technologies like AI/ML, RPA, and BPM to streamline and automate the entire invoice lifecycle, from receipt to payment. An invoice automation software extracts and updates data from invoices in your enterprise resource planning (ERP) system and routes the invoices to approval workflows automatically. It enhances accounts payable workflows by reducing manual data entry, minimizing potential errors, and improving efficiency.

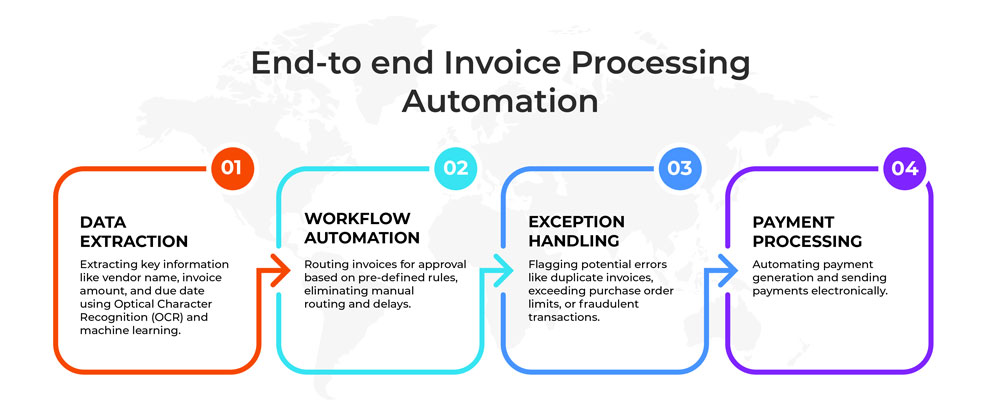

Businesses receive invoices through multiple channels such as emails, dropbox, and scanned physical documents. The first step is to collect and consolidate invoices from disparate sources and capture the key information. Data is extracted from the invoices with Optical Character Recognition (OCR) and machine learning. Let’s take a look at the key technology and processes involved in Invoice Process Automation.

Advanced ML models analyze vast amounts of invoice data to identify patterns and exceptions. They are constantly learning and improving to improve accuracy and efficiency. It involves tasks like

Intelligent data extraction: ML algorithms go beyond simple OCR they use context based data extraction to capture key information like vendor name, invoice amount, and line items with high accuracy.

Invoice categorization: ML can automatically classify invoices based on vendor type, expense category, or project code, streamlining workflows.

Anomaly detection: Advanced ML models detect potential errors like duplicate invoices, financial frauds, misappropriations, or exceeding purchase order limits, ensuring data integrity.

Robotic Process Automation (RPA)

Tireless bots automate repetitive tasks and free your financial team from tedious manual processes like data entry, matching data, and tracking invoices. These digital workers streamline payment processing across your accounting systems to reduce costly errors and improve efficiency. Invoice routing: Based on predefined rules (e.g., invoice amount, department), RPA routes invoices for approval to the appropriate person or team. Payment batch generation: RPA automates the creation of payment batches, saving time and minimizing errors.

Workflow Management

This step involves strategic mapping and streamlining the flow of invoices through the review and approval process. Users can define rules for routing, escalation procedures, and automatic notifications, ensuring timely approvals.

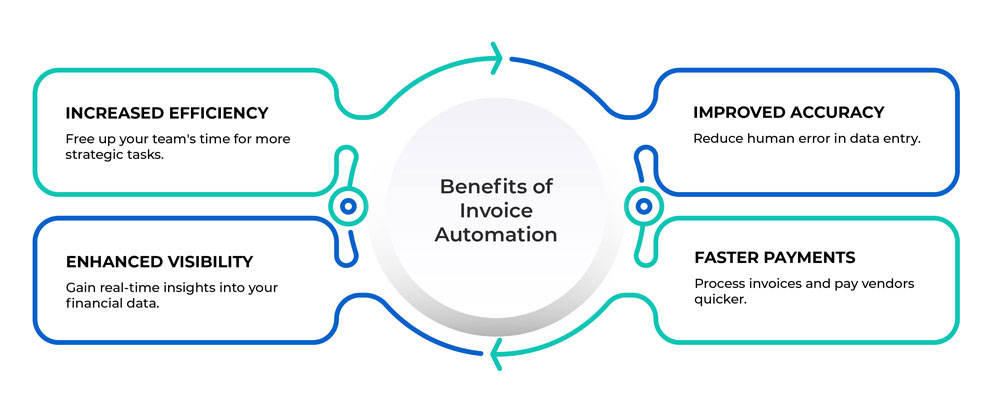

Benefits of Invoice Processing Automation

Improved Efficiency and Accuracy:

Reduced Manual Data Entry: Eliminate manual data entry errors and save time by automating data extraction from invoices. (Reduces processing time by 10x compared to manual processing)

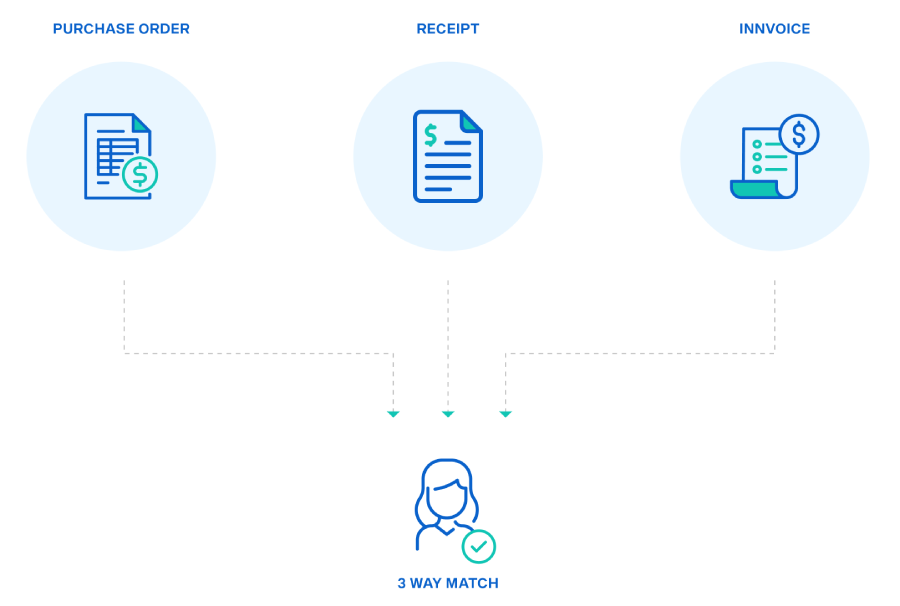

Automated 3-Way Matching: Automatically verify invoices against purchase orders and receiving reports to prevent fraud and duplicate payments.

Automated Routing and Approvals: Route invoices for review and approval to the appropriate managers based on pre-defined rules, ensuring timely processing.

Enhanced Visibility and Control:

Centralized Records: Access all invoice data and documents electronically for easy retrieval and improved information flow.

Real-Time Monitoring: Track key metrics across workflows in real-time to identify and resolve bottlenecks for faster processing.

Improved Audit Preparation: Maintain an audit-ready system with secure data storage and easy access to invoice records.

Cost Savings and Scalability:

Reduced Processing Costs: Minimize human effort required for invoice processing, freeing up staff for more strategic tasks.

Leverage Early Payment Discounts: Faster processing allows you to take advantage of vendor discounts for early payments.

Increased Scalability: Easily handle growing invoice volumes without needing to hire additional staff.

Strengthened Relationships and Risk Management:

Improved Vendor Relationships: Ensure timely payments and keep vendors happy with transparent communication on invoice status.

Reduced Business Risk: Minimize errors, fraud, and lost invoices with secure data storage and access controls.

Enhanced Compliance: Maintain compliance with company policies and regulations through automated workflows and data storage.

Steps to Implement Invoice Process Automation

Invoice processing automation is going to save you time and resources. However, you need to understand and map your current invoice processing workflow. This includes finding the number of invoices processed per month and average processing time. You need to identify bottlenecks and areas for improvement in your existing processes first. It might be processing time, errors, manual hours, etc.

2. Choose the right software

Consider factors like budget, integrations, and ease of use. (Here’s where Docketry shines! See below for more on Docketry’s strengths)

Choose the best invoice automation software based on the specific requirements of your business. While many solutions exist, Docketry stands out for its:

- User-friendliness: Designed with ease of use in mind, even for non-technical users.

- Customization: Tailor workflows to your specific needs.

- Scalability: Suitable for businesses of all sizes.

- Advanced Features: Offers features like AI-powered data extraction and real-time reporting.

- Security: Docketry adheres to industry-standard security practices to protect your sensitive financial data.

Support: Provides reliable customer support, comprehensive training, and ongoing maintenance for smooth implementation and continuous improvement.

3. Streamline data migration & workflow Setup

Centralize your data: Upload historical invoices into the chosen software. This creates a central repository for all your financial data. Most platforms offer a central dashboard for managing vendors, invoices, payments, and more.

Configure automated data extraction: Set up rules for the software to automatically extract key information from invoices. This eliminates manual data entry and reduces processing time.

Establish flexible workflows: Configure your system to handle various invoice types, including:

- Recurring billing

- One-time invoices

- Metered, volume, and tiered charging models

- Subscriptions

- Subscriptions

- Self-service payments

Secure 3-way matching: Automate 3-way matching to verify invoices against purchase orders and receiving reports. This helps prevent fraud and duplicate payments.

Integrate the software with your existing systems and train your team.

Seamless integration: Integrate the invoice automation software with your existing accounting system for a smooth workflow.

Collaborative configuration: Work with your software vendor to configure the system to your specific needs and ensure seamless integration.

System testing: Conduct rigorous testing before fully implementing the system. This allows you to identify and address any potential issues. Gather feedback from your team during the testing phase.

Comprehensive training: Provide comprehensive training to your team so they can leverage the new system effectively. A well-trained team is crucial for maximizing the benefits of automation.