20 Aug The use of Intelligent Document Processing (IDP) for KYC processing in banks

40 % of the onboarding time in banks is taken by KYC and account opening in banks, according to McKinsey research.

Clients want easy, intuitive, user-friendly digital access to services. Yet often, they get tangled in lengthy approval processes and must provide the same information over and over.

Know Your Customer, or KYC is essential and not just for compliance reasons. It is a critical step to protect institutions and prevent financial crimes. Around half of the banks in the McKinsey survey reported that they do not have any digital solutions for KYC processing. Even when they have, these are not integrated with other solutions creating silos and gaps in the workflows.

But let’s face it. manual KYC processing is costly, inefficient, error-prone, and time-consuming

Clients want easy, intuitive, user-friendly digital access to services. Yet often, they get tangled in lengthy approval processes and must provide the same information over and over.

Know Your Customer, or KYC is essential and not just for compliance reasons. It is a critical step to protect institutions and prevent financial crimes. Around half of the banks in the McKinsey survey reported that they do not have any digital solutions for KYC processing. Even when they have, these are not integrated with other solutions creating silos and gaps in the workflows.

But let’s face it. manual KYC processing is costly, inefficient, error-prone, and time-consuming

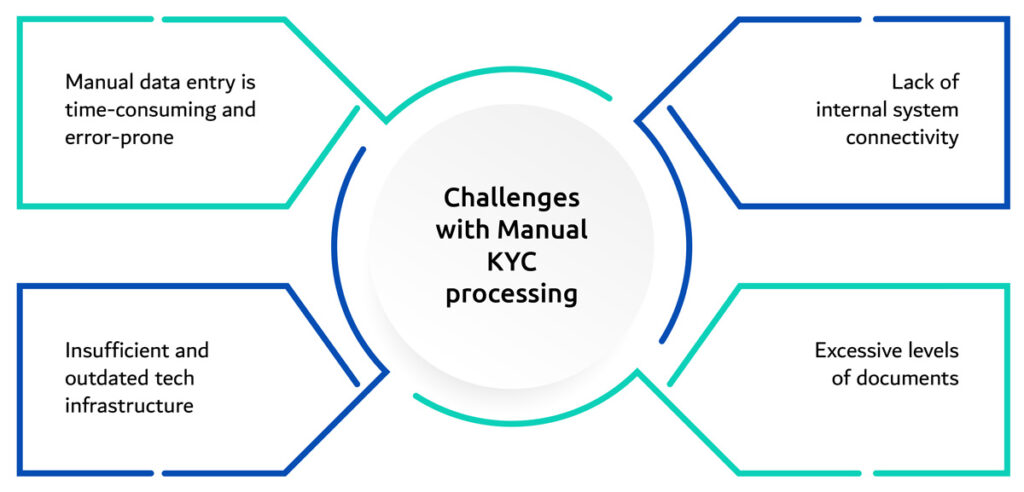

Challenges with Manual KYC processing

Manual KYC processing drains time and resources, resulting in long onboarding processes and disgruntled customers.

And the solution? Intelligent document processing and document automation.

And the solution? Intelligent document processing and document automation.

KYC in banking and IDP software

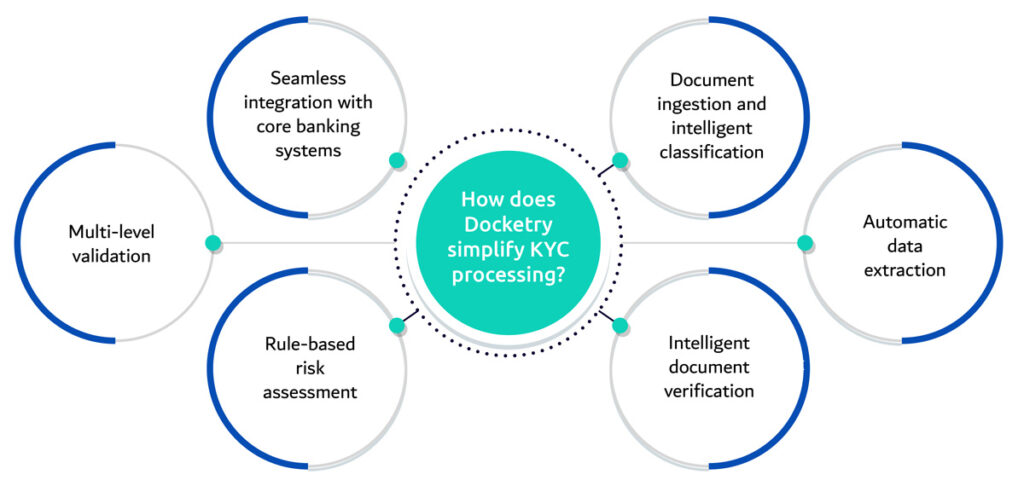

Intelligent Document Processing (IDP) is a powerful solution to overcome these challenges. IDP leverages artificial intelligence (AI) and machine learning (ML) to automate document processing tasks traditionally performed by humans. Unlike traditional OCRs, IDPs can process documents in structured and unstructured format and have inbuilt learning. IDP can significantly enhance efficiency and accuracy in KYC processing. When automating KYC document processing, there are three major steps,

Document classification: IDP automatically classifies different types of documents (passport, utility bill, etc.) based on pre-defined rules, streamlining the process and routing documents to the right channels.

Automatic data extraction: IDP systems can extract relevant information from various documents, including names, addresses, dates of birth, and identification numbers with high accuracy. IDP solutions like Docketry have handwriting recognition and multi-language capabilities. This eliminates the need for manual data entry, minimizing errors and saving time.

Verification and fraud detection: Multiple factors can indicate a fraudulent transaction. IDP solutions can be used to validate signatures or they can be integrated with external databases to verify the extracted information and identify potential inconsistencies that may indicate fraudulent activities.

Document classification: IDP automatically classifies different types of documents (passport, utility bill, etc.) based on pre-defined rules, streamlining the process and routing documents to the right channels.

Automatic data extraction: IDP systems can extract relevant information from various documents, including names, addresses, dates of birth, and identification numbers with high accuracy. IDP solutions like Docketry have handwriting recognition and multi-language capabilities. This eliminates the need for manual data entry, minimizing errors and saving time.

Verification and fraud detection: Multiple factors can indicate a fraudulent transaction. IDP solutions can be used to validate signatures or they can be integrated with external databases to verify the extracted information and identify potential inconsistencies that may indicate fraudulent activities.

The Advantages of Automated KYC Processing

By implementing automated KYC document processing, banks can reap a multitude of benefits: Increased efficiency: Automating repetitive tasks frees up bank employees to focus on more complex customer interactions and risk assessments.

- Enhanced accuracy: IDP reduces human error in data entry and verification, leading to a more accurate customer database.

- Faster customer onboarding: Reduced processing times facilitate quicker account opening and a smoother customer experience.

- Reduced costs: Automation minimizes resource requirements and associated costs for KYC compliance.

- Improved regulatory compliance: Automated data extraction and verification ensure consistent adherence to KYC regulations.

Choosing the Right IDP Partner

When selecting the best IDP solution for your bank, you need to carefully consider the bank’s specific needs and existing infrastructure. Here are some key factors to evaluate:

Document types

Choose an IDP solution that can handle the specific document types your bank encounters during KYC processes (e.g., passports, driver’s licenses, etc.).

Level of automation

KYC verification includes multiple processes from document classification and data extraction to full document verification and risk scoring. What is the desired level of automation you need? This involves identifying the bottlenecks in the current process and you might need to conduct a cost-benefit analysis.

In addition to KYC processing automation, if you want to automate the entire onboarding process and provide your customers with a streamlined and fast onboarding experience, you need to consider RPA, intelligent bots along the IDP solution. Look for a solution provider who has proven experience in intelligent automation and can deliver the level of customization you require.

Integration Capabilities

The banking industry is growing at a very fast rate and technology is often a big hurdle in the competition. Modernizing outdated systems and integrating new solutions with existing systems is vital for tech-driven growth. Ensure the IDP solution integrates seamlessly with your existing core banking system and other relevant applications.

Security & Compliance

Rules, regulations, and compliance requirements vary across countries and industries. Data security and breaches are a major concern for everyone. You need to ensure a solution that prioritizes data security and adheres to relevant industry regulations.

Document types

Choose an IDP solution that can handle the specific document types your bank encounters during KYC processes (e.g., passports, driver’s licenses, etc.).

Level of automation

KYC verification includes multiple processes from document classification and data extraction to full document verification and risk scoring. What is the desired level of automation you need? This involves identifying the bottlenecks in the current process and you might need to conduct a cost-benefit analysis.

In addition to KYC processing automation, if you want to automate the entire onboarding process and provide your customers with a streamlined and fast onboarding experience, you need to consider RPA, intelligent bots along the IDP solution. Look for a solution provider who has proven experience in intelligent automation and can deliver the level of customization you require.

Integration Capabilities

The banking industry is growing at a very fast rate and technology is often a big hurdle in the competition. Modernizing outdated systems and integrating new solutions with existing systems is vital for tech-driven growth. Ensure the IDP solution integrates seamlessly with your existing core banking system and other relevant applications.

Security & Compliance

Rules, regulations, and compliance requirements vary across countries and industries. Data security and breaches are a major concern for everyone. You need to ensure a solution that prioritizes data security and adheres to relevant industry regulations.

Conclusion

In banking, customer onboarding is the first step in a long-term relationship with your clients. A fast and easy onboarding experience can positively impact the time-to-revenue metric of growth as well. Intelligent automation is the way in the tech-driven future of banking.

Don’t settle for outdated KYC processes when you can have automated, intelligent, cost-effective solutions that drive productivity – explore Docketry for Banking.

Don’t settle for outdated KYC processes when you can have automated, intelligent, cost-effective solutions that drive productivity – explore Docketry for Banking.