18 Oct How Claims Automation Cuts Insurance Costs

In the intricate sphere of insurance, one crucial aspect often falls under the spotlight – claims processing. It’s the moment of truth for insurance companies, where policyholders eagerly await compensation for their losses, and they are ought to deliver on their commitment. Thus, timely and efficient claims processing drives customer satisfaction, loyalty, and cost reduction.

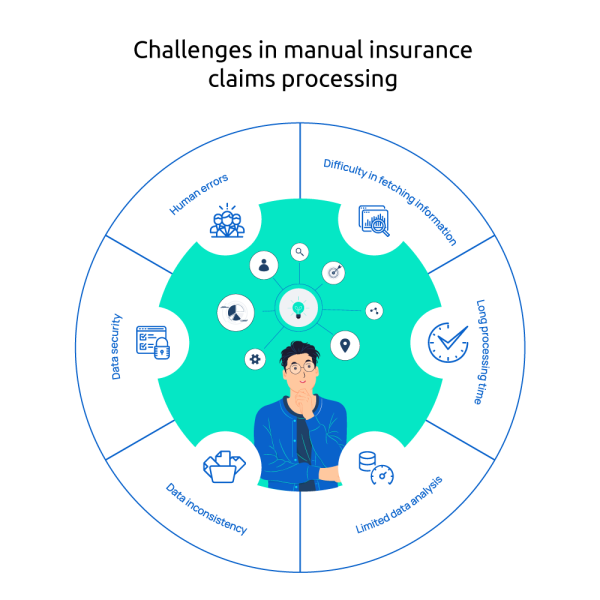

According to Deloitte, claims processing typically accounts for around 70% of insurers’ costs. Claims processing, as you know, has historically been a complex and labor-intensive manual process. It’s a process prone to errors and fraud, ultimately affecting the efficiency of claims processing and incurring high costs for insurance companies.

What is claims process automation?

The importance of efficient claims processing

Choosing the right data extraction solution

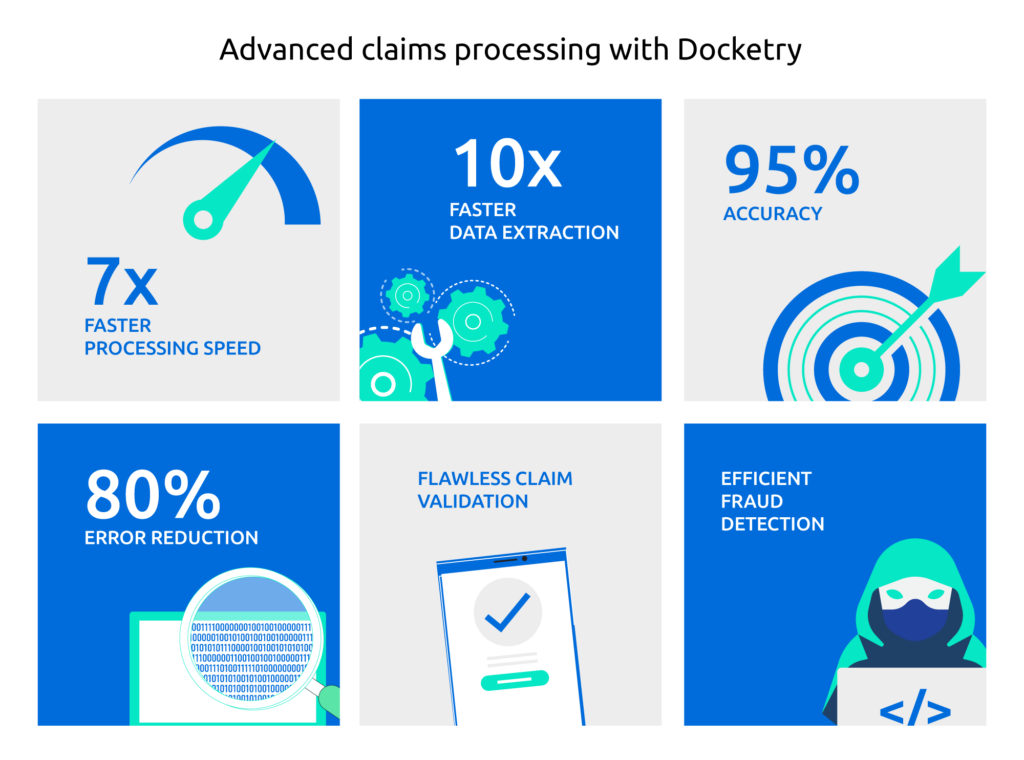

Selecting the right data extraction solution is a critical decision for businesses seeking to optimize their data management processes. With the vast amount of data available, it is essential to choose a solution that can efficiently extract, transform, and load data from various sources. Factors to consider include the solution’s compatibility with existing systems, scalability, ease of use, and security features. Additionally, the solution should offer advanced data cleansing and validation capabilities to ensure accurate and reliable data extraction. By carefully evaluating these factors and choosing a robust and flexible data extraction solution, businesses can streamline their operations, improve data quality, and make informed decisions based on reliable insights. A data extraction tool like Docketry can help businesses across businesses and industries to streamline their accounting processes.

How claims automation with Docketry cuts costs

Claims automation becomes the beacon of hope for the insurance industry. By implementing advanced AI technologies like Docketry insurance companies can significantly improve efficiency, reduce costs, and enhance the customer experience. Here are the ways in which claims automation helps in achieving these objectives:

Faster time to resolution

Prompt resolution of insurance claims is pivotal to customer satisfaction and cost management. Long-drawn-out claim processing leads to frustrated policyholders, potential loss of clients, and increased costs for insurance companies. Through automation the initial receipt and processing of claims documents become faster. The quicker you gather all the necessary data for a claim, the faster you can resolve it, reducing costs in the process.

Reduction of manual activity

Automating manual processes within claims submissions results in significant cost reductions and improved loss ratios. With AI handling tasks such as transcribing call centre phone calls and intelligent intake assessing damages based on photos, the need for extensive manual effort decreases, speeding up the adjudication process.

More complete claims submissions

Automation allows insurance companies to gather more data from claims documents. This extensive data collection facilitates more nuanced adjudication of claims, especially in commercial insurance. A fair and accurate assessment of claim exposure reduces costs related to loss ratios and impacts both loss and combined ratios positively.

Detection of insurance fraud

AI technologies help in identifying fraudulent claims efficiently. Technologies like intelligent intake can process and understand data and compare it to other datasets, enabling the detection of fraud. Recognizing potential indicators of fraud that might be challenging for humans to identify reduces loss ratios by flagging claims that should be denied.

Improved customer experience

By streamlining processes and reducing the need to ask customers to submit the same documents multiple times, claims automation not only cuts costs but also enhances the customer experience. Faster claims processing leads to happier policyholders and higher NPS, ultimately boosting the reputation of insurance companies.

The future of claims processing in the insurance industry

- The use of Intelligent Document Processing (IDP) for KYC processing in banks

- Step-by-Step Guide to Invoice Process Automation

- Automating 10 crucial manufacturing documents with intelligent document processing (IDP)

- Driving Efficiency with AI: A Look Into the Future of Intelligent Document Processing

- Comprehensive Guide to Data Extraction with RPA